The Visa B2B Connect network enables bank-to-bank, cross

border payments between businesses.

Streamlined cross-border payments

Deliver the experience your business customers want by improving how they transact international business. Visa B2B Connect is an innovative new network designed to enable participating financial institutions and their business customers to make global business payments that are streamlined, secure, and predictable.

Diagram uses icons in Visa gold and blue colors to illustrate a simplified cross-border payment transaction.

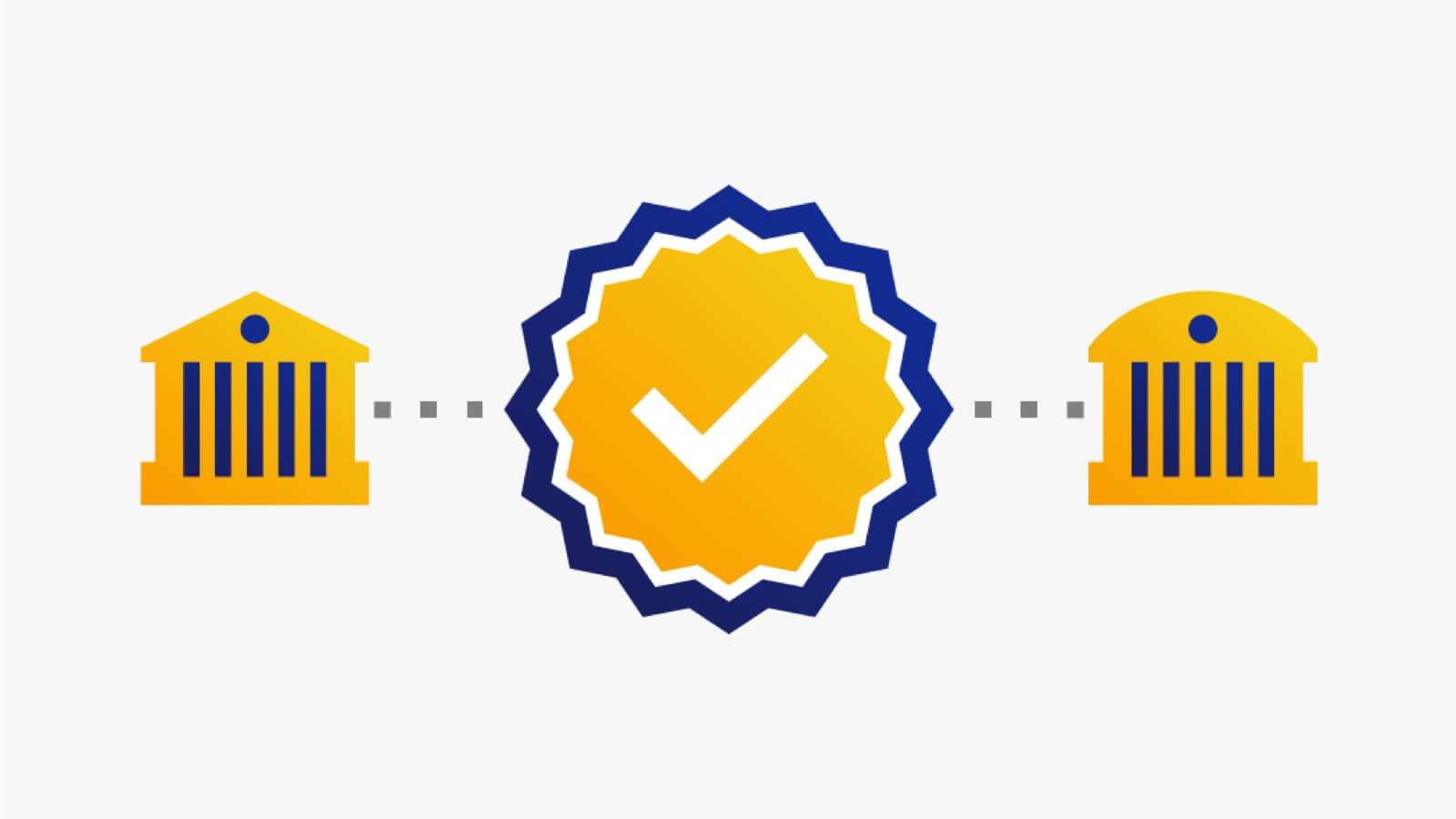

The graphic shows a streamlined transaction of how Company A would send a payment to Company B and also how Company B could pay Company A. The transaction begins with Company A on the left, passes through its bank, Bank A, located immediately to its right, and then through the Visa B2B Connect network to Company B’s bank, Bank B on the right, and finally to Company B.

Company A is represented with a corporate building icon. Company A connects to the icon of Bank A immediately to its right with an arrow, indicating the flow of payment. Bank A icon is located along the far left edge of a circle that represents the reach of the Visa B2B Connect network. Inside this circle is a symbol for Visa B2B Connect. At the far right side of the circle, there is an icon for Bank B, indicating Bank A and Bank B are both part of the Visa B2B Connect network. The transaction from Bank A to Bank B flows through the Visa B2B Connect network. Bank B then connects directly to Company B on its immediate right side with another arrow, indicating how the payment will ultimately reach Company B after traveling directly between the two banks across the Visa B2B Connect network.

The bilateral arrows between the icons show that Company B could also pay Company A by initiating a payment through its Bank B.

Global payments through a single connection

Visa B2B Connect's multilateral payment network enables cross-border transactions directly between any banks connected to the platform for a more consistent and streamlined payment experience.

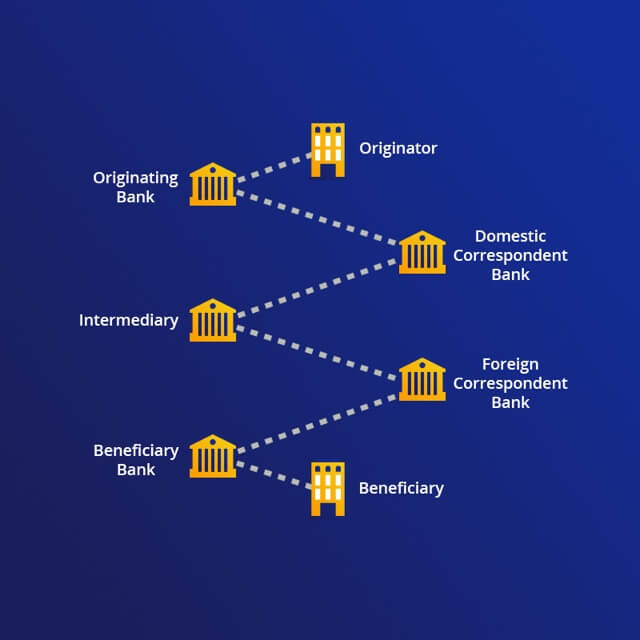

Legacy bilateral network

Bilateral networks like the one above often require multiple handoffs and handshakes between banks with disparate systems in distant locations before reaching the beneficiary—this can introduce delays, unpredictable costs, and inconsistencies in transaction data.

Visa B2B Connect multilateral network

As a multilateral network, Visa B2B Connect allows one-to-many global transactions to be sent directly between any participating banks, streamlining payments with greater transparency and predictability.

Legacy bilateral network

Diagram uses icons in Visa gold and blue colors to depict an illustration of a generic cross-border payment transaction being made on a legacy bilateral network, in which an originator business sends funds to a beneficiary business in another country via a series of banks connected by the legacy bilateral network.

The diagram presents a sequence of labeled business and bank icons connected by dotted lines in a downward left-right-left, zig-zag configuration, to illustrate transaction flow.

The transaction flows as follows: Originator business issues a transaction through its Originating Bank, which sends transaction instructions to a Domestic Correspondent Bank, which in turn passes those instructions to an Intermediary bank, followed by a Foreign Correspondent Bank, before reaching the Beneficiary Bank and being credited to the account belonging to the Beneficiary Business.

Visa B2B Connect multilateral network

Diagram uses icons in Visa gold and blue colors to depict an illustration of a generic cross-border payment transaction in which a payment can be transmitted between the originator bank and any participating banks connected to the Visa B2B Connect network without passing through multiple intermediary banks.

The diagram presents a circle surrounding the Visa B2B Connect network symbol. Along this circle’s perimeter are a number of bank icons presented around the upper half of the circle, as well as a larger bank icon at the bottom of the circle, representing the originator bank. All banks around the circle are connected to the Visa B2B Connect network symbol with bi-directional arrows, representing the multilateral nature of the network.

Transforming the cross-border payments experience

Visa B2B Connect addresses limitations in existing bilateral wire transfer systems, offering key benefits and an improved experience.

Predictability and

real-time visibility

Improve real-time visibility into the status of transaction by reducing multiple handoffs in the payment chain.

Transparency and Finality of Payment

Transparent network information with finality of settlement.

Consistency of transaction data

Consistent data enables seamless transaction experience for financial institutions and their business customers with simplified reconciliation.

Digital identity

Unique digital identities tokenize sensitive business data and reduce opportunity for fraud.Interoperability

Able to work with and alongside legacy systems, Visa B2B Connect can help ease banks’ transition to tomorrow’s payments.Multilateral network

Streamlines and transforms the payment path by offering a one-to-many global access, peer to peer exchange of value, and multilateral netting of large-value payments.Benefits of Visa B2B Connect

Visa B2B Connect offers the opportunity for banks and their business customers to streamline operations, reduce costs and enable growth.

Streamlined payments

Bank-to-bank payments with robust, streamlined data for improved transaction accuracy and easier reconciliation.

Transparency and finality

Clear transaction costs and payment schedules reduce uncertainty of payments.

Reduced complexity

A centralized network can reduce the number of relationships banks need to manage.

The Visa difference

Visa has the capabilities needed to provide a global solution to cross-border business payments.